Harnessing the Power of Generative AI in the Insurance Market

Blog -- 23 November 2023

Author: Marketing

The insurance sector is on the precipice of a major shift. This transformation is being catalysed by the rapid advancements in Generative Artificial Intelligence (GenAI) and Large Language Models (LLM). At Verisk, we are not just observers of this change, we are active participants, through constant review and testing of new technologies and investment in our innovative solutions and insights for insurers and brokers.

The Potential and Challenges of GenAI

One of the primary concerns raised during our recent roundtable discussion was the identification of specific use-cases for GenAI that genuinely address real-world problems.

The industry is awash with potential applications of GenAI and LLM, but it's crucial to sift through the noise and pinpoint applications that move beyond traditional business logic or "old school" AI.

Data is the lifeblood of AI. The question of its sufficiency and efficacy is paramount. Can a single insurance carrier amass enough data to train a model effectively? The answer, based on our discussions, is a resounding "yes". This positive affirmation underscores the importance of not just the quantity but the quality of data in driving meaningful AI-powered solutions.

Document extraction, a seemingly mundane but critical task, is undergoing a revolution thanks to GenAI. The transition from Optical Character Recognition (OCR) to the more advanced LLM for document extraction was highlighted as a prime example of GenAI's potential. However, the extraction is just one part of the process. The subsequent storage and utilisation of this data are equally crucial. Without a robust system to store and leverage this extracted data, the entire exercise becomes an academic one.

Training models, especially dynamic ones like ChatGPT, come with their set of challenges. The evolving nature of these models means that insurers need to be agile. An update from the AI provider could necessitate a retraining of the model, making it imperative for insurance companies to have a flexible and adaptive approach.

Insights and Future Directions

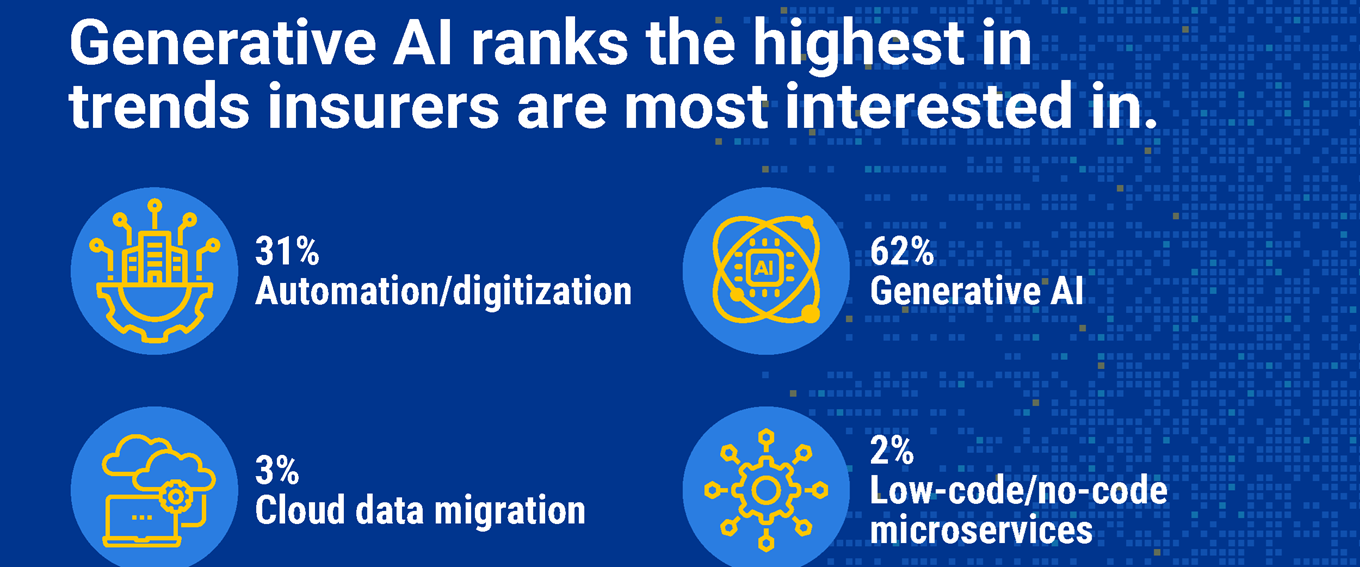

Our recent State of the Industry Survey at VIC London was an eye-opener. With a focus on understanding the pulse of the industry, the survey threw light on several key areas:

- The dual challenges of climate change and economic inflation are top of mind for industry professionals, with both challenges receiving equal attention from respondents.

- The overwhelming interest in Generative AI, with 62% of respondents expressing a keen interest, is a testament to its growing significance in the insurance landscape.

- The increased frequency and severity of natural disasters, a fallout of climate change, is seen as a significant risk, with 73% of respondents identifying it as the most challenging climate-related risk.

- The utilisation of data, especially placement, premium, and exposure data, is a topic of keen interest. Responses to our survey indicated a wide range of applications, from refining economic models to enhancing customer experience and automating analytics.

Furthermore, the integration of GenAI in the insurance sector is set to redefine customer interactions. With the ability to process vast amounts of data in real-time, insurers can offer personalised solutions tailored to individual needs. This personalisation extends beyond just product offerings. It encompasses every touchpoint in the customer journey, from onboarding to claims processing.

Moreover, the predictive capabilities of GenAI can help insurers anticipate market trends, enabling them to stay ahead of the curve. This proactive approach can also lead to the development of innovative products and services that cater to emerging market needs.

For instance, as climate change continues to pose significant risks, insurers equipped with GenAI can develop products that address these evolving challenges, providing customers with much-needed peace of mind.

In conclusion, the integration of Generative AI into the insurance sector is not just a possibility; it's an inevitability. At Verisk, we are at the forefront of this transformation, committed to harnessing the power of AI to drive efficiencies, enhance customer experiences, and shape the future of insurance. As the landscape continues to evolve, we remain steadfast in our mission to provide innovative solutions and insights that benefit our clients and the broader insurance industry.

Read Next

- 28 February 2025 - Blog A new era of Underwriting: Addressing Market Needs to Succeed

- 28 November 2024 - Blog What's your actuarial personality type?

- 08 November 2024 - Blog Data driven insight can be a game changer: the actuarial function in service of underwriting decision-making

- 30 October 2024 - Blog Rulebook Facts