Introducing The Insurance Platform.

As the market evolves, the technology supporting it must evolve too.

That’s why we’ve built something new - a platform that brings together modern architecture, intelligent workflows, and the flexibility to adapt to whatever comes next.

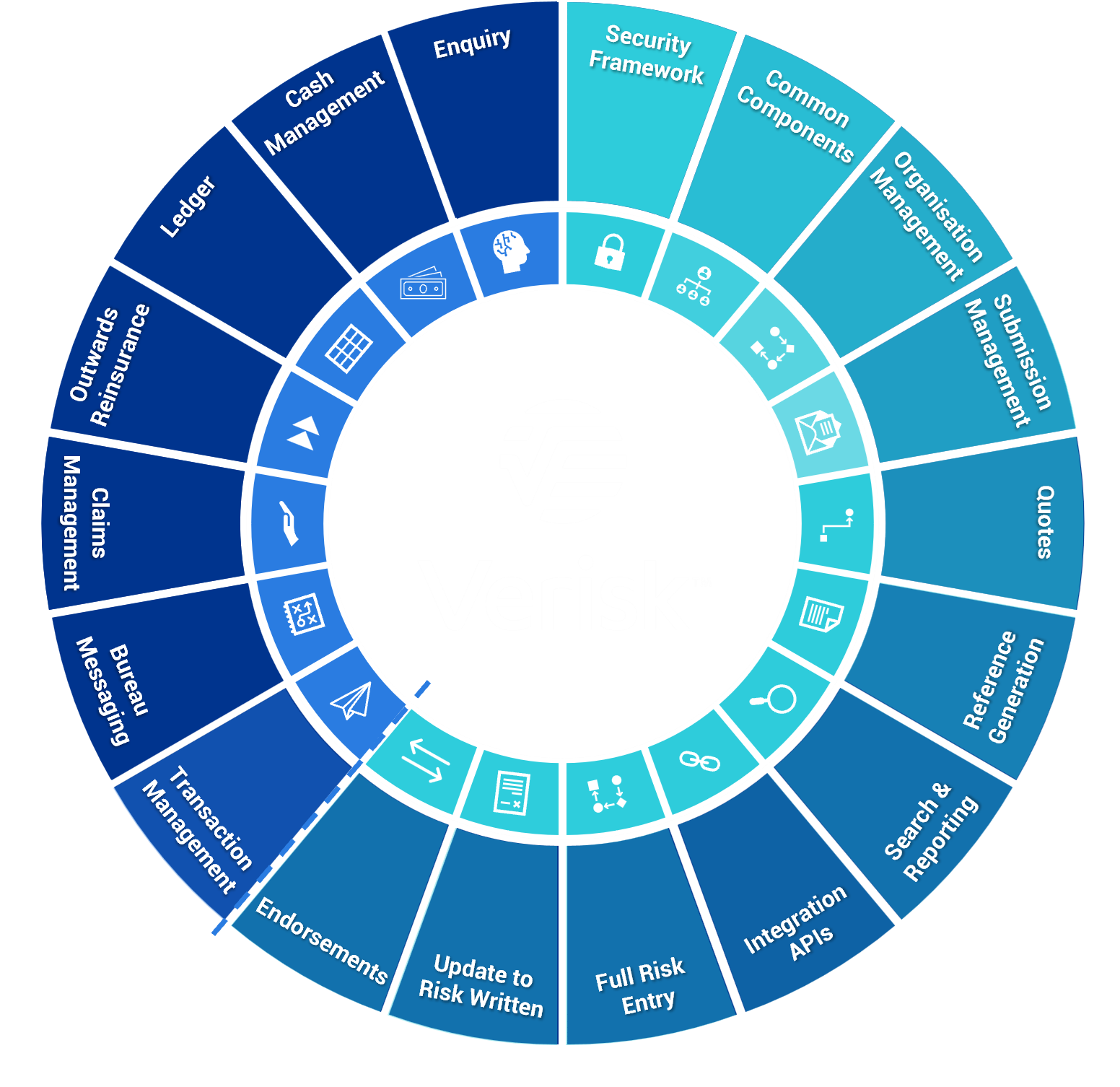

It supports the full insurance lifecycle - from submission to claims, from cash management to reinsurance - helping carriers move faster, connect smarter, and scale with confidence.

Modular by design, it allows you to deploy only what you need, when you need it. With an API-first foundation, it integrates seamlessly into your ecosystem. And every feature is built with purpose to solve real-world challenges and deliver measurable value.

Where the platform delivers

Submission chaos

Unsorted. Unstructured. Unclear.

Manual intake and inconsistent formats slow everything down. Our platform uses AI-powered submission handling tailored to your workflow, enabling straight-through processing from day one.

- Embedded Assistant gives you control over what data to pull in

- Whitespace integration for seamless intake

- Flexes between speed and precision

Instant insight

Context lives everywhere but here.

Data should work for you, not the other way around.

- Ask the right questions, when they matter

- No rigid filters - just natural, flexible interaction

- Insights embedded directly in your workflow

Complex risks

Complex programs. Inflexible tools.

You shouldn’t have to work around your system.

We support any program structure, no compromises.

- Built for flexibility, not workarounds

- Clean, intuitive UX that reduces clutter and cognitive load

- Keeps underwriters focused on decision-making, not admin

Pipeline blindness

No flow. No visibility.

When you can’t see the work, you can’t manage it.

- Kanban-style workflow gives live visibility across every stage

- Triage surfaces routine tasks, freeing time for high-impact decisions

- The work finds you, not the other way around

Hear from Chris Spencer,

Director of Underwriting Solutions

With over a decade of experience across underwriting and technology, Chris brings a rare depth of insight to his role as Director of Underwriting Solutions at Verisk. He began his career at Aviva, RSA, and Zurich before moving into product roles at IQUW and Verisk, giving him a deep understanding of both the challenges underwriters face and the tools they need to overcome them.

That experience now shapes how the platform delivers real value: built for underwriters, by underwriters. In this video, Chris shares how it supports the full policy lifecycle, helping underwriters make smarter decisions, faster, while cutting through the admin that slows them down.

Ready to take a leap?

We’ll be sharing more soon, including demos, customer stories, and deep dives.

Want to see to see the platform in action? Speak to an expert or book a personalised walkthrough with Chris or a member of the team.